Nvidia stock has made incredible gains over the past five years. It is only natural that competitors will emerge.

The chip maker for artificial intelligence Nvidia (NVDA -4.69%) has amassed a market capitalization of nearly $3.2 trillion, making it one of the largest chipmakers in the world. It now consumes more than 6% of the broader benchmark S&P500 index. Over the past five years, Nvidia’s annual revenue has increased by 458% and its stock has risen by a whopping 2,009%. Given AI’s potential to disrupt life as we know it, it’s understandable why investors are so excited about the stock.

But the lure of these kinds of profits will obviously attract competition. Now one of Nvidia’s competitors is planning an initial public offering (IPO), claiming to produce chips that can significantly outperform Nvidia at a fraction of the price. Let’s see.

20x better than Nvidia?

Last week, AI chipmaker Cerebras filed its registration statement with the Securities and Exchange Commission (SEC) with the intention of going public. In a 2021 press release, Cerebras said it had a valuation of $4 billion following a $250 million Series F financing round. The company is targeting a $1 billion IPO with a valuation of $7 billion to $8 billion.

In its registration statement, Cerebras lists Nvidia as a competitor, as well as other major AI companies such as Advanced micro devices, Intel, MicrosoftAnd Alphabet. Here is a description of what Cerebras does:

We design processors for AI training and inference. We build AI systems to power, cool and power the data from the processors. We develop software to connect these systems together into industry-leading supercomputers that are easy to use even for the most complicated AI work, using well-known ML frameworks such as PyTorch. Customers use our supercomputers to train leading models. We use these supercomputers to perform inference at speeds not achievable with alternative commercial technologies.

The pitch of Cerebras is that bigger is better. That’s because the company has designed a chip that is the size of an entire silicon wafer, and the largest ever sold. The company believes the size advantage means less time moving data. Additionally, Cerebras has a flexible business model in which customers can purchase Cerebras products for use in their facilities or through a consumption-based subscription through the company’s cloud infrastructure.

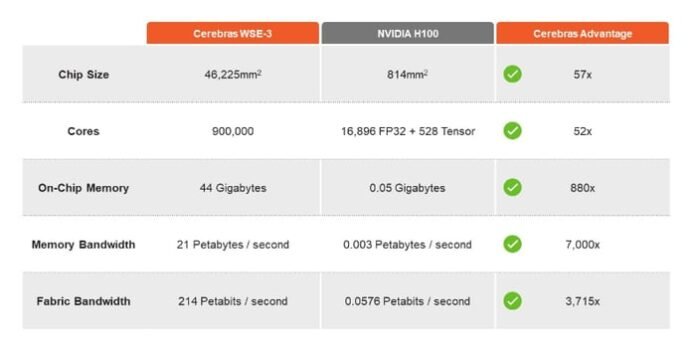

Cerebras clearly wants investors to compare, or at least associate, the company with Nvidia. Nvidia is mentioned 12 times in the registration statement. Cerebras also offers a side-by-side comparison of its Wafer-Scale Engine-3 chip against Nvidia’s H100 graphics processing unit (GPU), which is considered the most powerful GPU on the market.

Image source: Cerebras registration statement.

Cerebras CEO Andrew Feldman said publicly that the company’s inference offering is 20 times faster than Nvidia’s, at a fraction of the price. In 2023, Cerebras generated approximately $78.7 million in revenue, up 220% year over year. Through the first half of 2024, Cerebras’ revenue grew to $136.4 million. The company still hasn’t turned a profit, after losing nearly $67 million in the first half of 2024. These numbers also pale in comparison to Nvidia, which recently reported second-quarter revenue of $30 billion and profit of about $16 .6 billion. .

Will Cerebras make a splash?

With major publicity from news publications and claims that it is 20 times faster than Nvidia, I think it’s safe to say that Cerebras has already made and will continue to make a big impression.

Depending on the excitement investment bankers can generate during the company’s roadshow and market conditions, I wouldn’t be surprised if Cerebras goes public at a higher valuation than expected. AI is all the hype and the IPO market has been flat for a few years, so there could be pent-up demand on Wall Street.

Will Cerebras overtake Nvidia? Only time will tell. Its product offering is impressive, but it still has a way to go to bring its financial profile in line with Nvidia. Additionally, there could be some advantages to Nvidia having smaller chips and it remains to be seen whether Cerebras can compete with Nvidia’s software language CUDA – although the company does say that its software program “eliminates the need for low-level programming in CUDA.”

While everything sounds great, there’s probably still a “show me” component to this story. After all, most of Cerebras’ turnover comes from one customer. Nvidia also has a leading market share in AI chips and has relationships with many major customers. Who says Nvidia couldn’t use its size (and likely resources) to develop a similarly large wafer chip? There’s still a lot to do, but this could be one of the more interesting developments for market observers to pay attention to.

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Bram Berkowitz has no positions in the stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices, Alphabet, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long calls in January 2026 for $395 at Microsoft, short calls in January 2026 for $405 at Microsoft, and short calls in November 2024 for $24 at Intel. The Motley Fool has a disclosure policy.