An incredible year like 2024 Artificial Intelligence (AI) stocks, it’s entirely possible that 2025 could be even better. There is still a lot of momentum and many positive catalysts on the horizon that could drive more growth. This is a market that most major players think will be huge. Analysis from Statista estimates the market to reach $826 billion by 2030.

Which companies are poised for serious growth as we approach the end of the year? While I don’t have a crystal ball, here are my top two choices.

1. The reigning champion remains at the top

Yes, Nvidia (NVDA 0.80%) still has room to run. The semiconductor giant is gearing up for another big year, driven mainly by sales of the soon-to-be-released “Blackwell” architecture, the latest version of its flagship AI-powered chips.

Much will be revealed next month about the company’s upcoming earnings and the guidance the company is setting, but it appears that 2025 could see a significant increase in sales as demand for the current “Hopper” chips skyrockets remains, despite Blackwell’s impending release. . The reported twelve month backlog for Blackwell orders should keep it that way. For example, Elon Musk recently purchased 100,000 H100s — there is more than one version of each iteration of chip architecture — and plans to purchase another 50,000 H200s soon.

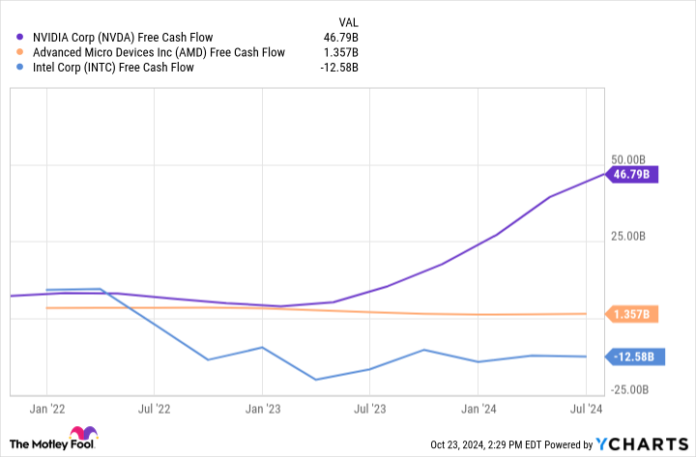

Nvidia’s competitors are struggling to keep pace and I don’t see them materially eroding Nvidia’s market share in 2025. AMD will release its next-generation AI chip around the same time Blackwell finally ships. Here’s the catch: it will be a direct competitor to the H200, not the (Blackwell) B200. AMD is a full cycle behind at this point. This will likely shrink, but Nvidia has a lot of money to drive the pace of innovation that AMD can’t match. Despite the catch-up, Nvidia spent about half of what it spent last quarter research and development.

Take a look at this chart, which shows the enormous amount of free cash flow (FCF) Nvidia has at its disposal to maintain its lead. Of course, money isn’t everything, but it certainly helps.

NVDA Free Cash Flow data by YCharts

2. Don’t underestimate Mark Zuckerberg

Meta (META 0.96%) has received a lot of criticism in recent years due to Mark Zuckerberg’s insistence that the metaverse will be the next big thing. It seems he’s not right about this: the company’s metaverse division, Reality Labs, posted a $4.5 billion loss last quarter.

But I don’t think this is the folly that many do; the metaverse can still be big. However, the reason I bring this up is that it shows that Meta is not afraid to take risks and bet big. Zuckerberg applies the same attitude to AI, investing heavily in building out his Meta AI and ultimately integrating that technology into the work that Reality Labs does.

The fact is that whether Reality Labs makes a profit or not, the company is still extremely profitable and seeing strong user and revenue growth across its suite of social media platforms. The company makes its money by selling targeted ads on its platforms, something AI could do. make it more efficient. It’s also one of the cheapest stocks in big tech. Only from the big players Alphabet has a lower one price-earnings ratio (P/E). I think this makes Meta an extremely attractive choice regardless of what happens with Reality Labs.

However, Meta has the opportunity to marry AI and the metaverse, something that, if done right, could be a game changer for the company. To be clear, this is conjecture, but it’s possible the company will release a demo of something in this vein in 2025.

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Johnny Rice has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices, Alphabet, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.