Whales with a lot of money to spend have taken a noticeably bearish stance T-Mobile USA.

Looking at the option history for T-Mobile US TMUS we detected 9 transactions.

If we consider the specifics of each trade, it is correct to say that 33% of investors opened trades with bullish expectations and 55% with bearish ones.

Of the total spotted trades, there are 3 puts, for a total of $93,590, and 6 calls, for a total of $400,835.

Predicted price range

Analyzing the volume and open interest in these contracts, it appears that the major players have been eyeing a price window of $190.0 to $260.0 for T-Mobile US over the past quarter.

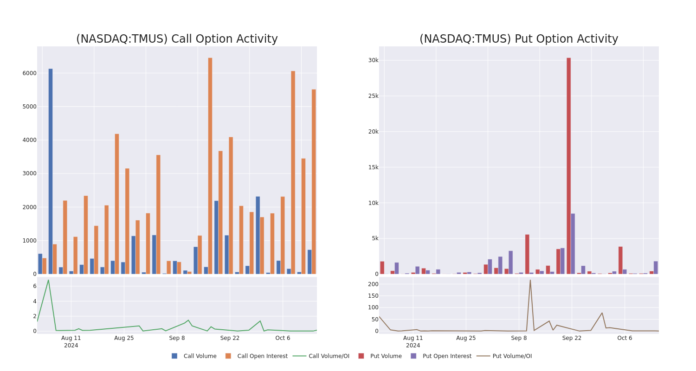

Volume and open interest trends

Looking at volume and open interest is an insightful way to perform due diligence on a stock.

This data allows you to track the liquidity and interest for T-Mobile US options at a given strike price.

Below we can see the evolution of the volume and open interest of calls and puts respectively for all of T-Mobile US’ whale activities within a strike price range of $190.0 to $260.0 over the last 30 days.

T-Mobile US options volume and open interest over the past 30 days

Notable options activity:

| Symbol | BUY/BELL | Trade type | Sentiment | Execution Date | To ask | Bid | Price | Exercise price | Total trading price | Open interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TMUS | PHONE CALL | TRADE | BULLISH | 16/01/26 | $36.75 | $36.3 | $36.75 | $200.00 | $183.7K | 679 | 50 |

| TMUS | PHONE CALL | SWEEP | BEARISH | 01-17-25 | $15.8 | $15.6 | $15.65 | $210.00 | $59.3K | 1.2K | 227 |

| TMUS | PHONE CALL | SWEEP | BULLISH | 20/12/24 | $30.15 | $29.6 | $29.95 | $190.00 | $54.0K | 1.3K | 331 |

| TMUS | PHONE CALL | TRADE | BEARISH | 20/06/25 | $4.9 | $4.8 | $4.8 | $260.00 | $48.0K | 7 | 100 |

| TMUS | PUT DOWN | SWEEP | BEARISH | 20/06/25 | $7.0 | $5.6 | $7.0 | $195.00 | $35.0K | 428 | 50 |

About T-Mobile USA

Deutsche Telekom merged its T-Mobile USA unit with prepaid specialist MetroPCS in 2013, and that company merged with Sprint in 2020, creating the second-largest wireless carrier in the US. T-Mobile now serves 77 million postpaid and 21 million prepaid telephone customers. equivalent to approximately 30% of the US wireless retail market. The company aggressively entered the wired and wireless broadband market in 2021 and now serves more than 5 million residential and business customers. T-Mobile also provides wholesale services to resellers.

In light of the recent options history for T-Mobile US, it is now appropriate to focus on the company itself. We want to examine current performance.

The current market status of T-Mobile US

- Trading volume stands at 1,354,548, with TMUS price up 0.67% to $217.35.

- RSI indicators indicate that the stock may be overbought.

- Earnings announcement expected within 8 days.

Professional analyst ratings for T-Mobile US

Five market experts recently issued ratings on this stock, with a consensus price of $219.1.

From €1000 to €1270 in just 20 days?

20-year-old professional options trader reveals his one-line charting technique that shows when to buy and sell. Copy his trades, which averaged a profit of 27% every 20 days. Click here for access. *An Evercore ISI Group analyst maintains his stance on an Outperform rating for T-Mobile US, with a target price of $220. * In a cautious move, a Raymond James analyst downgraded his rating to Outperform, setting a price target of $221. *Consistent with their assessment, a Morgan Stanley analyst has an Overweight rating on T-Mobile US with a price target of $209. * Consistent with their evaluation, a Scotiabank analyst maintains a Sector Outperform rating on T-Mobile US with a price target of $215. * A JP Morgan analyst maintains his stance on an Overweight rating for T-Mobile US, with a target price of $230.

Options trading carries higher risks and potential rewards. Smart traders manage these risks by continually educating themselves, adjusting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay on top of the latest T-Mobile US options trades with real-time alerts from Benzinga Pro.

Market news and data powered by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.