Also in this letter:

■ Smartphone sales and Diwali

■ Slice, North East Bank merger

■ Udaan insures new debts

Swiggy sets the IPO price band between Rs 371-390 per share

Sriharsha Majety, Group CEO, Swiggy

Food and grocery delivery company Swiggy will price its upcoming initial public offering (IPO) between Rs 371-390 per share, according to sources.

Send the news: At the high end, this would bring the SoftBank-backed platform’s valuation to $11.3 billion. Swiggy is expected to file its prospectus with market regulator Securities and Exchange Board of India (Sebi) later today.

Swiggy’s last private valuation was $10.7 billion in January 2022, following a $700 million fundraising round led by US asset manager Invesco.

IPO details: The Rs 11,300 crore IPO will be one of the largest in India this year. The issue is likely to start on November 6.

- Archrival Zomato’s market capitalization stood at around $26.5 billion at the close of trading on the BSE on Monday. That’s a 60% premium over Swiggy’s IPO prices.

- The public issue was first filed with Sebi in April and has seen companies like BlackRock, CPPIB and SBI Mutual Fund join as foreign and domestic investors.

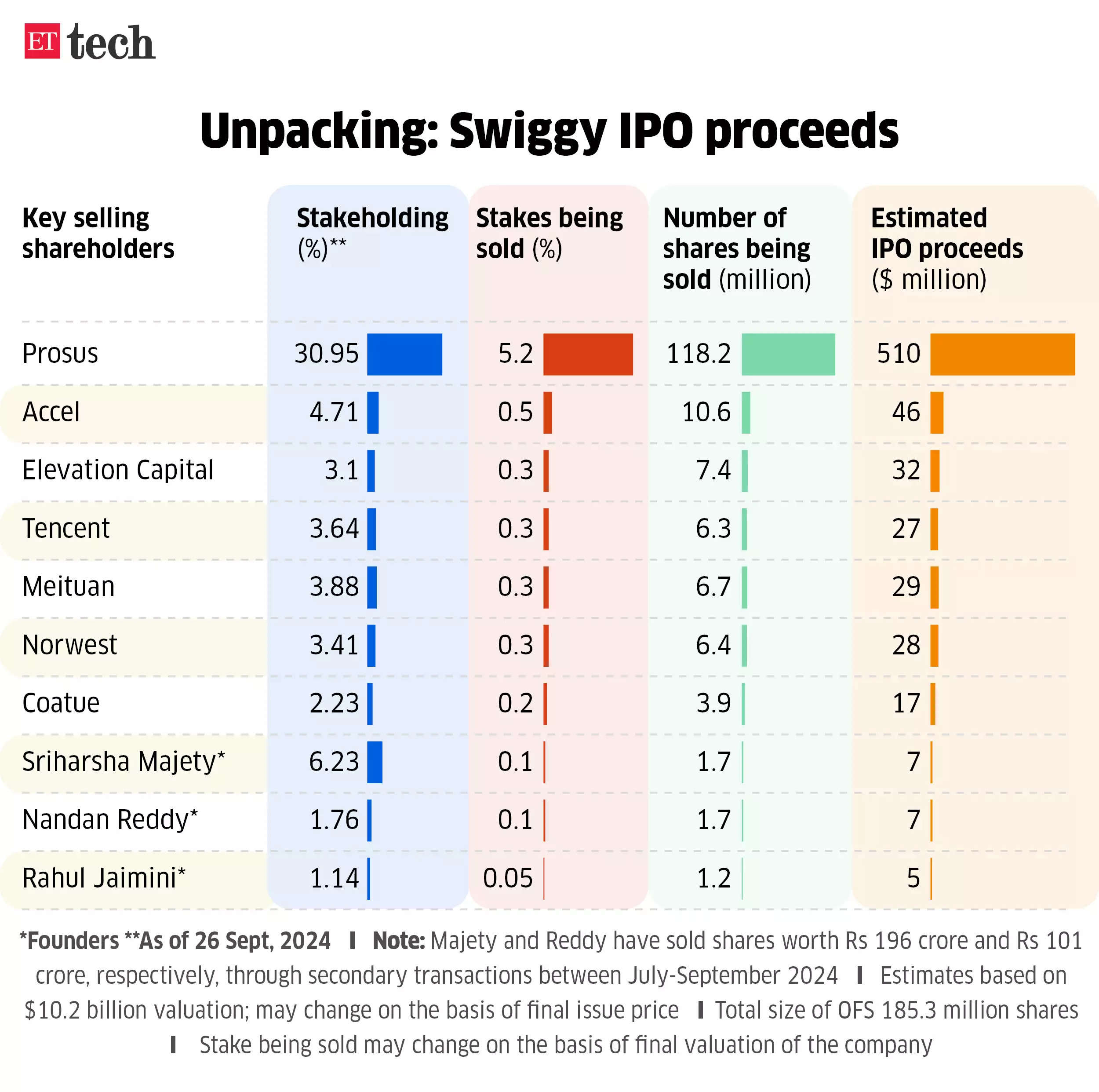

- As much as Rs 6,800 crore of secondary sales will be made through an offer for sale (OFS) with a primary capital of Rs 4,500 crore coming into the company.

- Prosus, which has a 31% stake in Swiggy, is expected to recover more than half of its total investment of around $1 billion.

- Early investors such as Accel, Elevation Capital and Norwest Venture Partners will sell stakes in Swiggy in the OFS.

- Founders Sriharsha Majety, Rahul Jaimini and Nandan Reddy are also selling some of their shares.

Also read: Zomato to raise Rs 8,500 crore through QIP to combat fast-paced commercial competition

Flipkart marketplace revenue grows 21% to Rs 17,907 crore, reducing losses by 41% in FY24

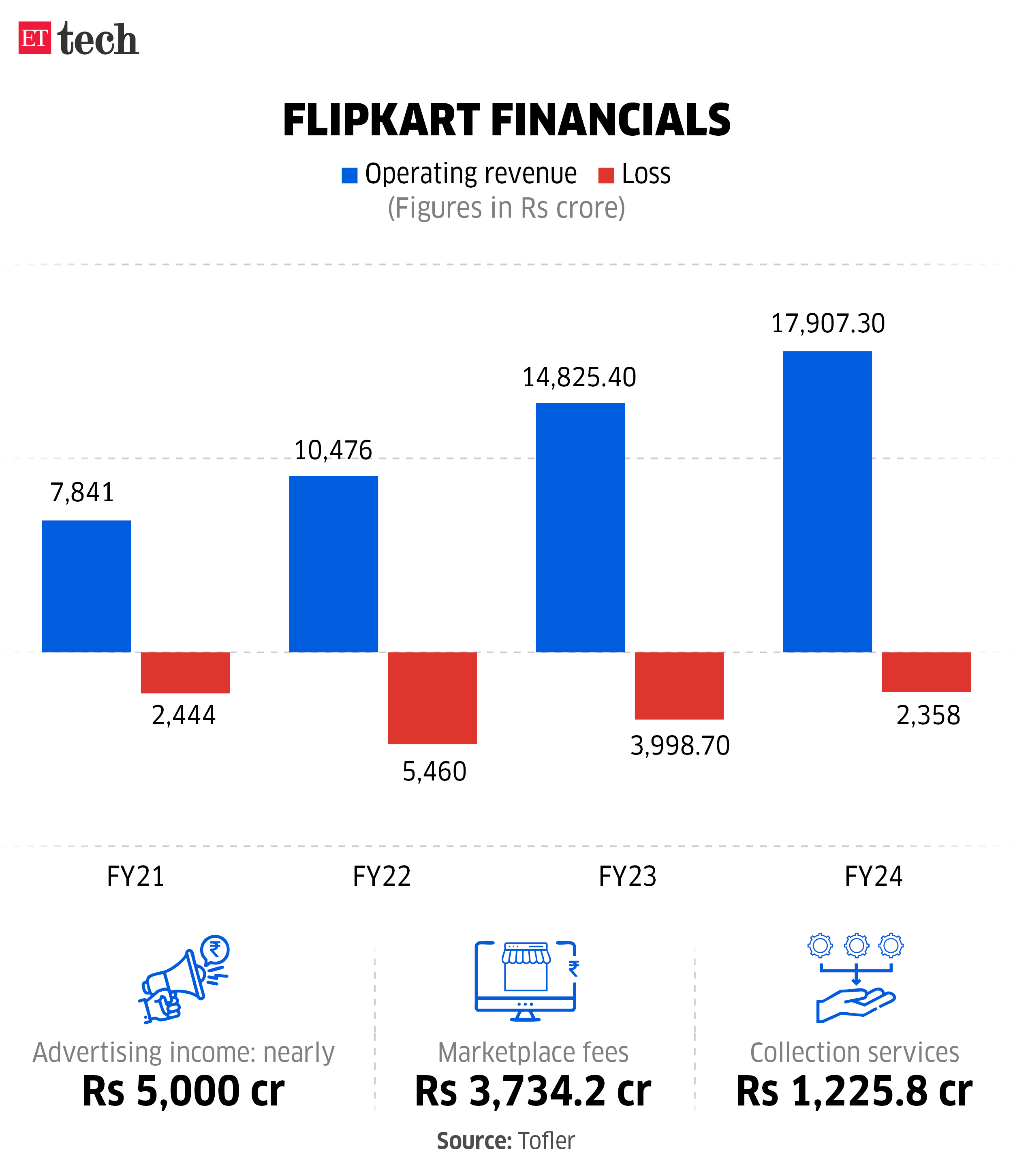

Flipkart Internet, the market arm of Flipkart, reported revenues of Rs 17,907.3 crore for 2023-24, up nearly 21% year-on-year, while losses fell 41% to Rs 2,358 crore, according to regulatory filings sourced from Business Intelligence platform Tofler.

Revenue Streams: In a significant shift, Flipkart Internet’s advertising revenue exceeded that of marketplace fees. It earned nearly Rs 5,000 crore from advertising in 2023-24, compared to Rs 3,325 crore the year before. It generated a marketplace fee of Rs 3,734 crore and Rs Rs 1,226 crore in collection services.

Wholesale numbers: Flipkart India – the wholesale unit of the e-commerce company – reported a revenue growth of over 26% to nearly Rs 70,542 crore in FY24, while losses stood at Rs 4,194 crore against Rs 4,845.7 crore – a decline of 13%.

How it works: Walmart-owned Flipkart operates its Indian business through multiple entities, with Flipkart Internet managing the market. This entity earns revenue primarily through seller commissions, advertising revenue, and other fees for seller services.

Cost optimization: Flipkart’s revenue growth, along with a reduction in losses, is in line with CEO Kalyan Krishnamurthy’s profitability targets, accompanied by a significant organizational restructuring that has helped lower operating costs.

Fast trading: Flipkart has entered the fast commerce space with its “Minutes” service to meet the rising demand for fast delivery, competing with Blinkit, Zepto and Swiggy Instamart, which promise 10-20 minute deliveries for groceries, electronics and more.

As competition intensifies, Amazon has set a target to launch in this segment in India in the first quarter of 2025, ET reported on August 28.

Also read: Tatas enters the high-speed trading space with ‘Neu Flash’

Smartphone sales are booming ahead of Diwali

Smartphone sales are rising in the run-up to Diwali after a tepid start to the festive season, with brands offering heavy discounts and offers, supported by higher margins for retailers.

Send the news: According to market watchers and retailers, sales on Saturday rose almost threefold week-on-week, with footfall in major metros such as Delhi, Mumbai and Kolkata increasing by around 30%.

Retailers said sales in offline channels have started picking up around Dussehra and should peak just before Diwali.

Data shows: According to Counterpoint Research, the first phase of smartphone sales during the holiday season saw a volume decline of 3 to 4% year-on-year, while value rose 8%.

This year, the industry expects a 60-65% increase in sales value during the festive season compared to the regular sales period, a senior sales executive of a major smartphone company said on condition of anonymity.

Market demand: A distributor from South India reported that mobile companies have increased their sales targets by 40-50%, offering retailers 1-2% extra margins and extended warranties as incentives. Demand for premium Samsung, Vivo and Apple smartphones is high, with average prices rising by Rs 1,000-23,000, while Xiaomi’s budget 5G models are also popular.

E-commerce marketplaces like Amazon and Flipkart also offer deep discounts on high-end mobile phones, especially older models from Samsung and Apple.

Also read: Fast trading companies are rolling up their sleeves for a big piece of festival cake

Slice completes merger with North East Small Finance Bank

Rajan Bajaj, Founder and CEO of Slice

Bengaluru-based fintech startup Slice on Monday said it has completed its merger with North East Small Finance Bank (NESFB) with effect from October 27, after receiving all required approvals from shareholders and regulators.

Tell me more: The integration will pave the way for the creation of a technology-driven bank, along with a strengthened financial position, aimed at expanding operations, improving risk management frameworks and improving customer experience.

CEO speaks: “For more than a year, the Slice and NESFB teams have worked tirelessly to make this merger a reality. We are especially committed to strengthening our roots in the Northeast and aim to bring more people into the formal banking system,” said Rajan Bajaj, CEO of Slice.

To summarize: Slice received RBI approval to merge with the beleaguered NESFB in October 2023, following which it filed with multiple regulators for the merger. The nod from the Competition Commission of India came in March this year and the National Company Law Tribunal cleared the merger in August.

Udaan closes another Rs 300 crore in debt from Lighthouse Canton, Stride Ventures and others

Vaibhav Gupta, CEO, Udaan

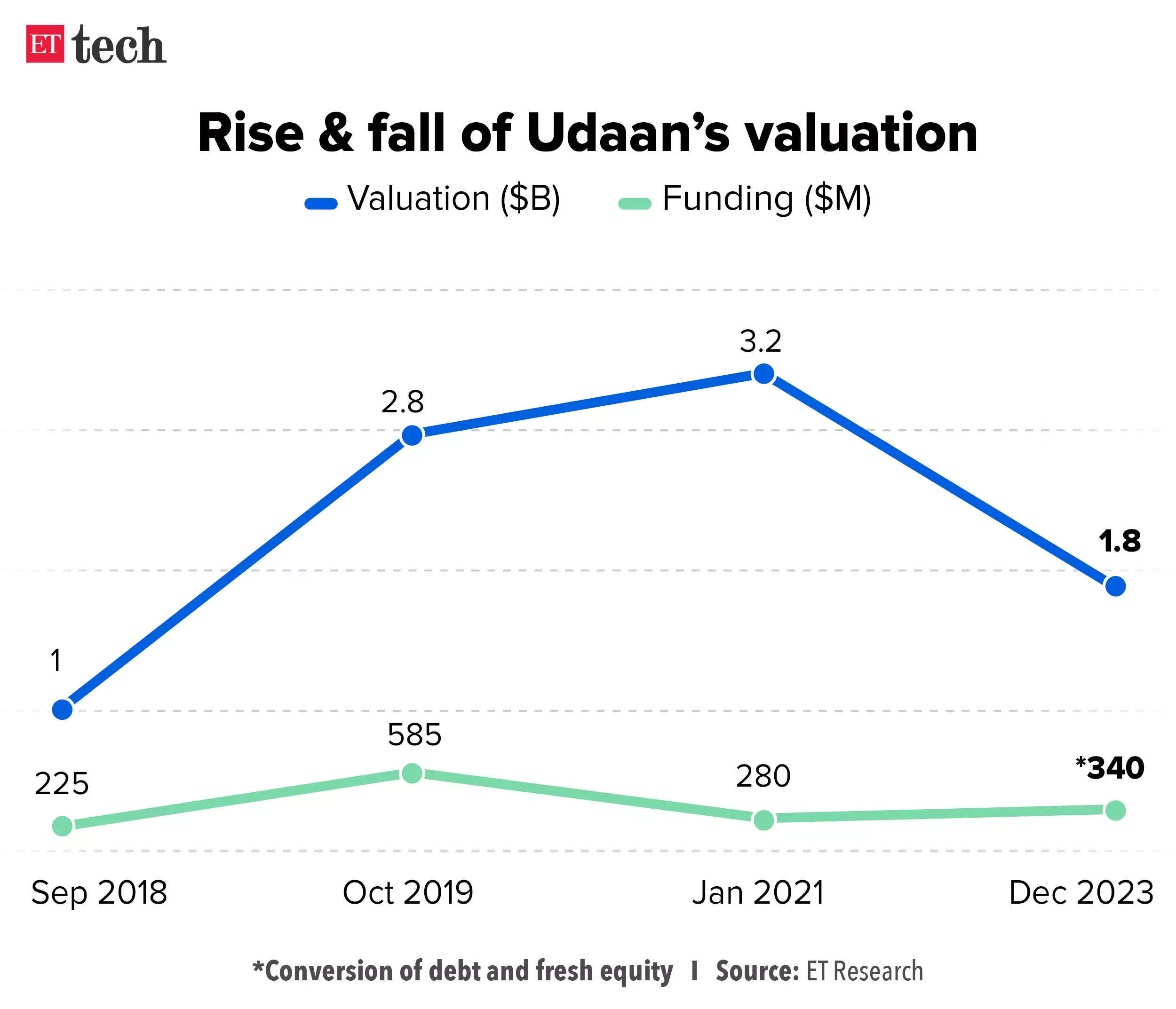

Udaan, a business-to-business (B2B) e-commerce company, on Monday said it has completed a debt financing round of around Rs 300 crore from Lighthouse Canton, Stride Ventures, Innoven Capital and Trifecta Capital.

Tell me more: The unicorn will use the new capital to expand its geographic footprint through its ‘micro market strategy’, optimize operations, enhance go-to-market (GTM) capabilities, streamline supply chain processes and build new micro fulfillment centers to open.

To summarize: On October 23, we reported that British savings and investment firm M&G Prudential is in talks to lead a new funding round of $80-100 million for the Bengaluru-based company.

Today’s ETtech Top 5 newsletter was curated by Riya Roy Chowdhury in Bengaluru.