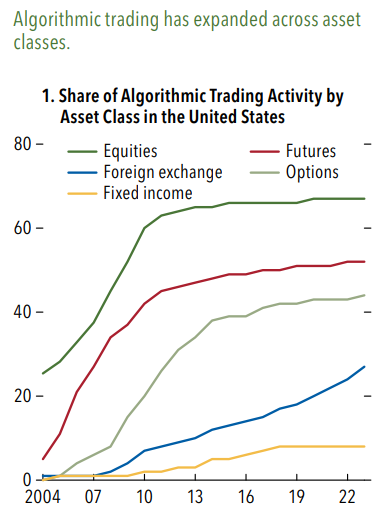

ORLANDO, Florida, Oct 17 (Reuters) – Technology has been the main driving force behind the evolution of financial markets in recent decades, with the explosion of automated and algorithmic trading fueling the dazzling speed, efficiency and liquidity that traders and investors have . enjoy today.

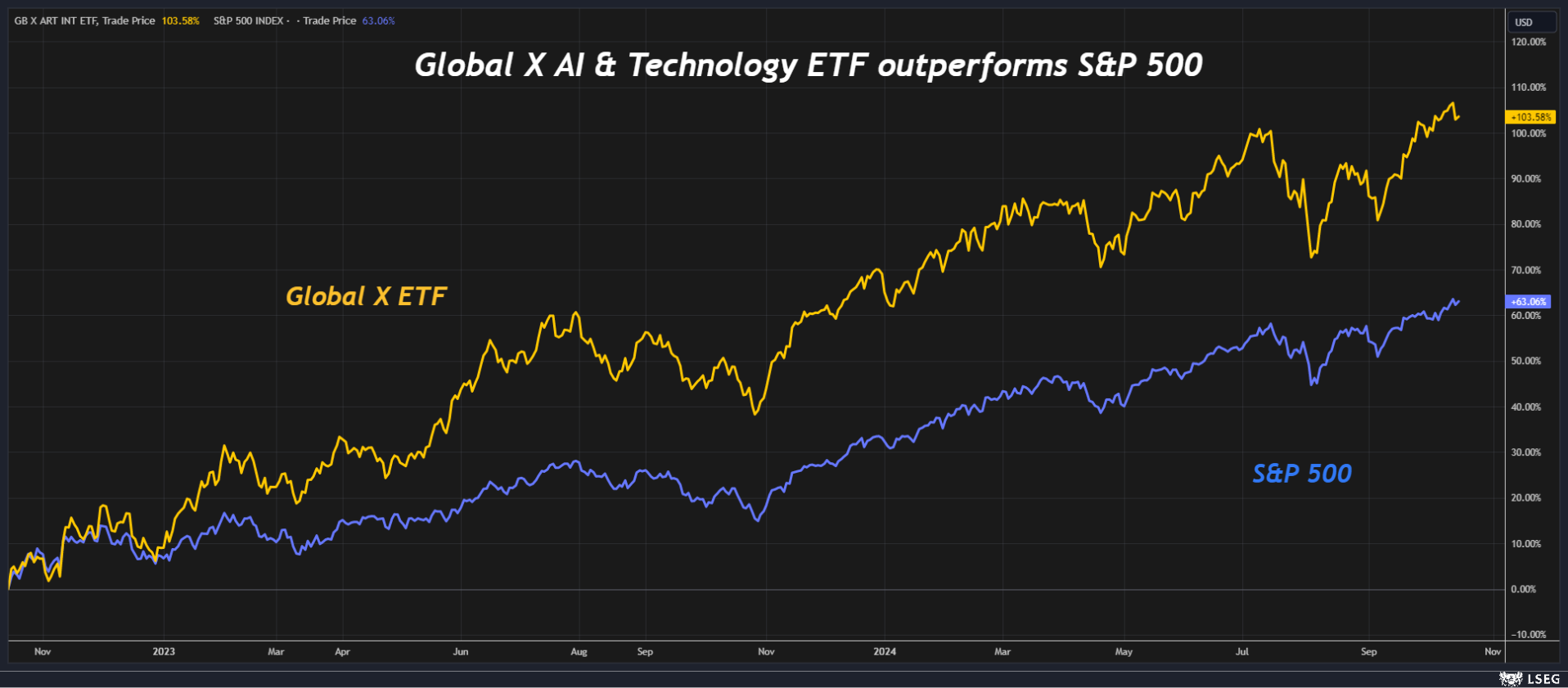

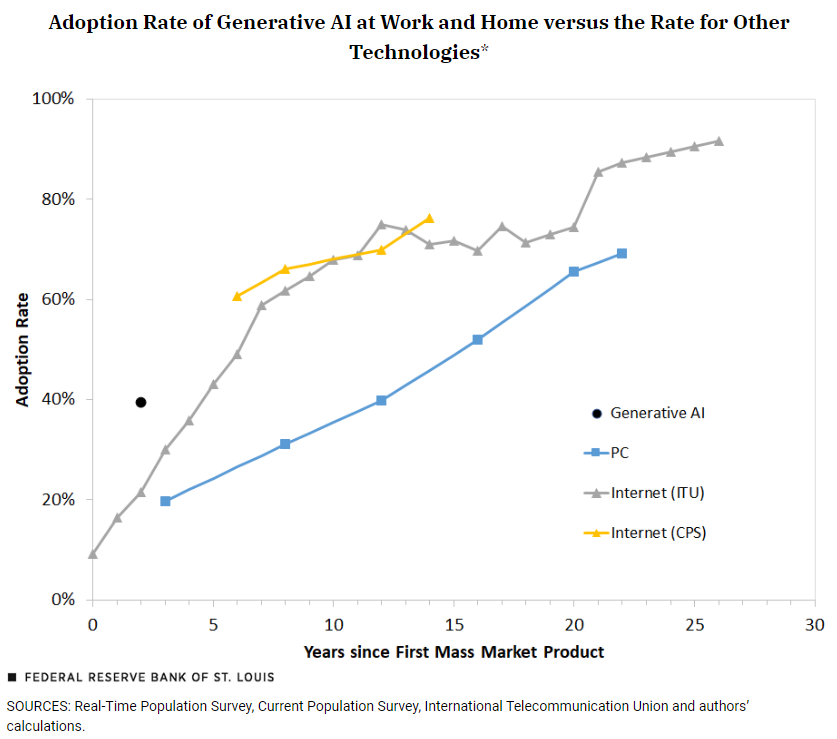

Artificial intelligence is likely to accelerate these positive changes and revolutionize financial markets along the way.

But the benefits come with potential dangers, including the risk of making markets more vulnerable to frequent bursts of short-term turbulence and volatility.

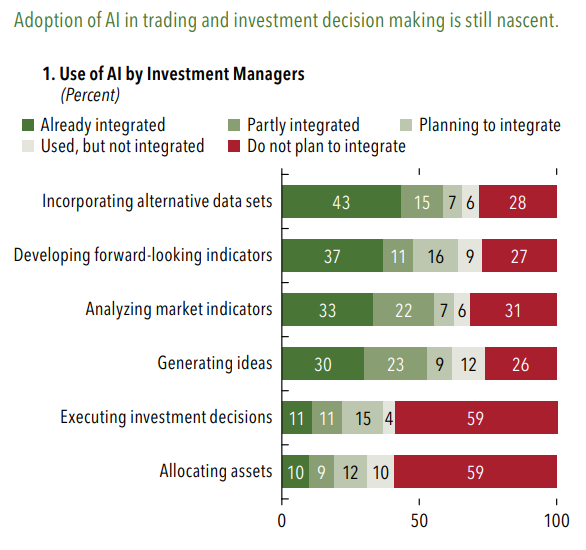

The financial sector is participating in this trend. The International Monetary Fund notes that when Large Language Models first appeared in 2017, only 19% of patent applications related to algorithmic trading contained AI content. That figure rose to over 50% in 2020 and has remained above that level since. This suggests that a ‘wave of innovation’ could be on the way in financial markets.

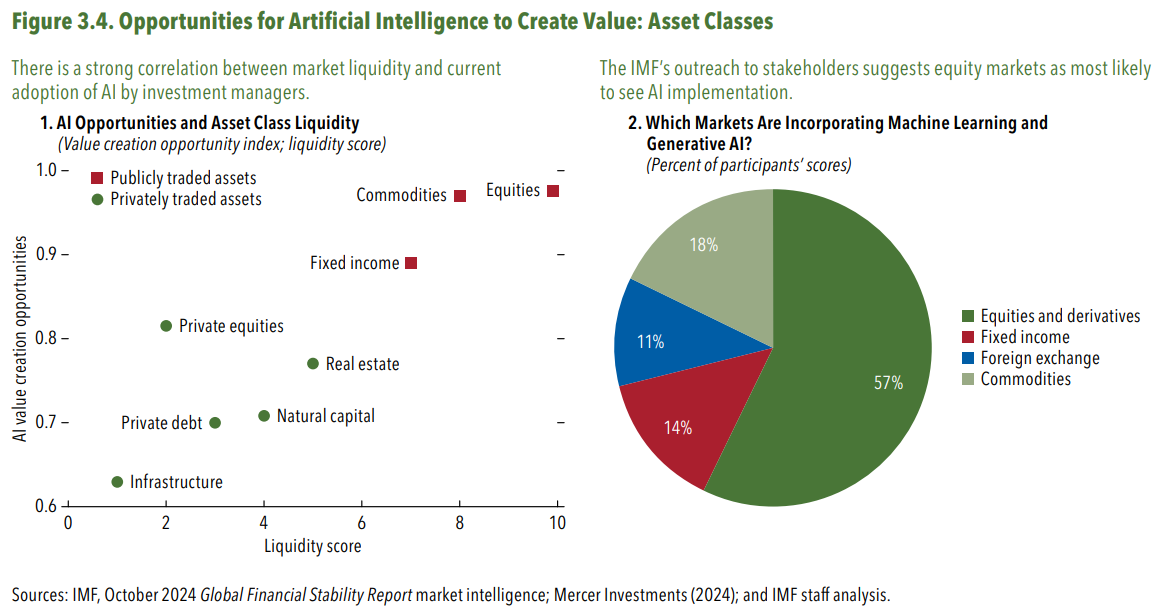

This could be very good news for the financial sector, as AI has the potential to take the efficiency of trading, investing and asset allocation to new heights.

Generative AI’s ability to instantly analyze large amounts of information could improve market performance by generating more accurate trading signals, improving risk management, strengthening trading models and identifying trends.

AI also has the potential to improve liquidity and help smooth out price distortions in markets across a wide range of instruments that do not lend themselves to automated trading, such as corporate bonds.

It’s true that if everyone used the same technology, any trading advantage could diminish over time, but this would likely only fuel the drive for more innovation as investors try to stay one step ahead.

CASCADING AND PRESENT

Of course there are also serious risks.

One of the most relevant concerns is the possibility of a sudden evaporation of liquidity, and even trading halts, during periods of high volatility as market participants scramble to minimize losses. Algorithmic trading strategies, enhanced by AI, could create a ‘cascading’ effect that triggers negative feedback loops.

The risk of “potential herd and market concentration” is particularly acute, the IMF notes, if only a handful of providers design the AI programs and large language models that power these algos. This is probably the case at the moment.

The IMF notes that there is already evidence that the US stock market has seen algo-driven liquidity dry up – albeit only briefly – during times of high stress. This reflects the fact that many participants are essentially on the same side of the trade and their models are designed to respond to many situations in the same way.

Furthermore, AI will likely accelerate the shift of market-making activities to less regulated corners of the financial universe, such as hedge funds, proprietary trading firms and other non-bank financial intermediaries.

Greater opacity will make it more difficult for regulators and authorities to monitor these activities, which could in turn create more opportunities for cyber-attacks, market manipulation, fraud and the spread of disinformation online.

But there is no going back to the pre-AI world. Markets have little choice but to accept and embrace technology. This means that investors – and financial regulators – must accept the potential risk, disruption and danger that AI can bring, along with its many benefits.

(The views expressed here are those of the author, a columnist for Reuters.)

Sign up here.

By Jamie McGeever; Editing by Paul Simao

Our Standards: Thomson Reuters Trust Principles.

The opinions expressed are those of the author. They do not reflect the views of Reuters News, which is committed to integrity, independence and freedom from bias under the Trust Principles.