Keep in mind that you probably don’t have the same goals as a billionaire.

Investors looking for investment ideas often turn to the investment ideas of billionaires. This may make sense, because you often reach billionaire status by making wise investment decisions.

One problem with this approach is that a billionaire may have different investment goals than an average investor looking to accumulate wealth over his lifetime. Instead of pursuing long-term profits, a billionaire can buy a stock as a short-term trade. We don’t know in advance what billionaires will do, and we probably won’t Why they make the investment decisions they make. So while it makes sense to see which stocks the super-rich like, average investors need to go the extra mile and confirm that a stock meets their investment needs.

Let’s take a look at three stocks that billionaires have recently purchased shares of.

Amazon

Admittedly, Amazon (AMZN 0.78%) is more of a known quantity for investors of all wealth levels. Its leadership in online retail and cloud computing has made it a favorite among consumers and investors alike.

While the online sales business has not been a growth center, it has benefited from subscription sales, third-party merchant services, and advertising. Moreover, amid strong growth in cloud computing and AI, the AWS business continues to generate the majority of Amazon’s operating revenue.

Although net sales rose just 11% annually in the first half of 2024, a sustained recovery from 2022’s weakness saw profits rise 141% over the same period.

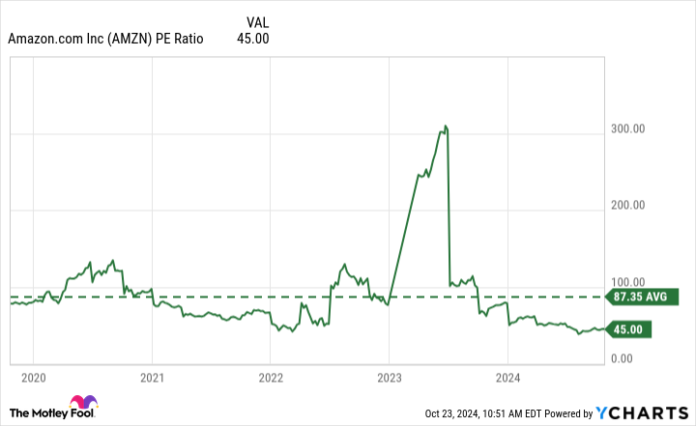

Additionally, while the price-to-earnings ratio of 45 may not sound cheap, it is well below the stock’s average earnings margin of 87 over the past five years.

AMZN PE ratio data according to YCharts

That may have helped attract several billionaire investors to the stock in the second quarter of 2024. Ken Griffin, Ray Dalio and Paul Tudor Jones are just a few of the billionaires who added positions during the quarter.

With numerous businesses and a liquidity position of $89 billion, Amazon is among the safest individual stocks to own, likely making it an excellent choice for average investors.

Invesco QQQ Trust

Another notable “stock pick” of billionaires is an exchange-traded fund (ETF) that owns the 100 non-financial stocks on the stock exchange. Nasdaq-100 index. The Invesco QQQ Trust (QQQ 0.61%) tends to attract investors at all interest rate levels, as individual components tend to have little influence.

Although it contains 100 stocks, its weighting varies. His top company, Appleconstitutes just under 9% of the fund at the time of writing. Furthermore, the top 10 stocks, all but one of which are technology stocks, make up just over 50% of assets.

The Invesco QQQ Trust has performed well for investors. While the return of 37% over the past year is close to the S&P500Thanks to the company’s performance, a return of 436% over ten years, that index has almost doubled.

So it’s no wonder investors like billionaires Cliff Asness and Steven Cohen added shares in the second quarter. For them, this was likely a way to balance security and significant growth. Considering the safety of the multi-stock fund and its returns, the ETF is a sensible option for most investors.

Super microcomputer

Super microcomputer (SMCI 2.25%) has fallen from obscurity in recent years as a collaboration with Nvidia led to a huge increase in demand for its servers.

Volatility has been particularly pronounced over the past year as the stock rose past the split-adjusted level of $120 per share in March. However, investors began selling and sentiment soured after a short-seller report from Hindenburg Research in late August and the announcement that it would delay the filing of its latest 10-K report with the SEC. (Keep in mind that short sellers make money when the stocks they short fall, so they have an incentive to spread pessimism.)

Millennium Management – led by billionaire Israel Englander – bought shares of Supermicro in the second quarter, before the short report, and I think given that the price-to-earnings ratio is 24 and analysts are predicting 51% earnings growth in the 2025 fiscal year, some Risk-tolerant investors may feel justified in buying shares now, despite potential accounting issues that could come to light if the short seller is right.

However, it’s impossible to know how things will turn out, so I think Supermicro is a stock for speculative money, and one that risk-averse investors should probably avoid.

Invest like billionaires

Billionaires can make excellent stock choices. Indeed, billionaires do not achieve that status by making lousy stock selections. While no one is right 100% of the time, average investors should do their own due diligence to find out if a particular stock is right for their portfolio.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Will Healy holds positions in Super Micro Computer. The Motley Fool holds and recommends positions in Amazon, Apple, and Nvidia. The Motley Fool has a disclosure policy.