T-Mobile USA TMUS is preparing to announce its quarterly results on Wednesday 23-10-2024. Here’s a quick overview of what investors should consider before the announcement.

Analysts expect T-Mobile US to be one earnings per share (EPS) of $2.43.

There is a tense reaction to T-Mobile US’ announcement, with investors hoping to hear that expectations are exceeded and that positive guidance is received for the next quarter.

New investors need to understand that while earnings performance is important, market reactions are often driven by guidance.

Past earnings performance

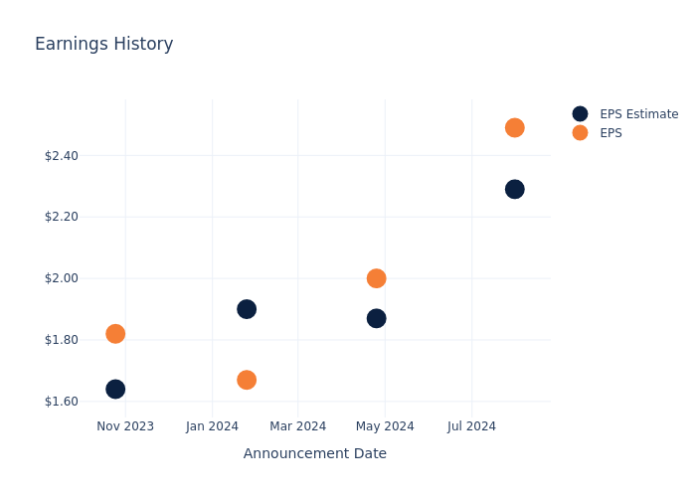

The company’s earnings per share fell by $0.20 last quarter, leading to a 2.63% increase in its stock price the following day.

T-Mobile US stock price analysis

Shares of T-Mobile US traded at $222.77 on October 21. Over the past 52-week period, shares have risen 55.93%. Given that these returns are generally positive, long-term shareholders should be happy when they announce these earnings numbers.

Analyst insights on T-Mobile US

For investors, it is of utmost importance to stay abreast of market sentiment and industry expectations. This analysis provides an exploration of the latest insights into T-Mobile US.

Analysts have given T-Mobile US a total of 18 ratings, with the consensus rating being Outperform. The average one-year price target is $222.81, indicating a potential upside of 0.02%.

Comparison of peer ratings

In this comparison, we examine analyst ratings and one-year average price targets of Millicom Intl Cellular, Gogo and Spok Holdings, three prominent industry players, providing insight into their relative performance expectations and market positioning.

- Millicom Intl Cellular received an Outperform consensus from analysts, with an average one-year price target of $33.83, implying a potential downside of 84.81%.

- The analyst consensus outlook is a neutral trajectory for Gogo, with an average one-year price target of $12.17, indicating a potential downside of 94.54%.

- Spok Holdings received a neutral consensus from analysts, with an average one-year price target of $15.0, implying a potential downside of 93.27%.

Comparative peer analysis summary

The peer analysis summary highlights key metrics for Millicom Intl Cellular, Gogo and Spok Holdings, providing insight into their respective industry positions and providing insight into their market positions and comparative performance.

| Company | Agreement | Sales growth | Gross profit | Return on equity |

|---|---|---|---|---|

| T-Mobile USA | Surpass | 3.00% | $13.02 billion | 4.69% |

| Millicom Intl mobile | Surpass | 4.67% | $1.10 billion | 2.14% |

| Gogo | Neutral | -1.13% | $66.76 million | 1.47% |

| Spok Holdings | Neutral | -6.80% | $26.82 million | 2.15% |

Key Takeaway:

T-Mobile US ranks at the top among its competitors in terms of revenue growth and gross profit. It is in the middle for return on equity.

Get to know T-Mobile US better

Deutsche Telekom merged its T-Mobile USA unit with prepaid specialist MetroPCS in 2013, and that company merged with Sprint in 2020, creating the second-largest wireless carrier in the US. T-Mobile now serves 77 million postpaid and 21 million prepaid telephone customers. equivalent to approximately 30% of the US wireless retail market. The company aggressively entered the wired and wireless broadband market in 2021 and now serves more than 5 million residential and business customers. T-Mobile also provides wholesale services to resellers.

T-Mobile US: Delving deeper into financial services

Market capitalization: The company’s market capitalization exceeds industry norms and confirms its dominance in terms of size, indicating a robust market position.

Sales growth: T-Mobile US showed positive results in 3 months. As of June 30, 2024, the company achieved solid revenue growth of approx 3.0%. This indicates a remarkable increase in the company’s sales. Compared to others in the communications services industry, the company excelled with a growth rate that was higher than the industry average.

Net margin: T-Mobile US’s net margin exceeds industry standards, underscoring the company’s exceptional financial performance. With an impressive 14.79% net margin, the company manages costs effectively and achieves strong profitability.

Return on Equity (ROE): The company’s ROE is performing excellently and exceeding industry averages. With an impressive ROE of 4.69%, the company shows effective use of equity.

Return on Assets (ROA): T-Mobile US’s ROA exceeds industry standards and underlines the company’s exceptional financial performance. With an impressive 1.41% ROA, the company uses its assets effectively for optimal returns.

Debt management: T-Mobile US’s debt-to-equity ratio is below the industry average. With a ratio of 1.82the company is less dependent on debt financing, thereby maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

To track all earnings releases for T-Mobile US, visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market news and data powered by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.