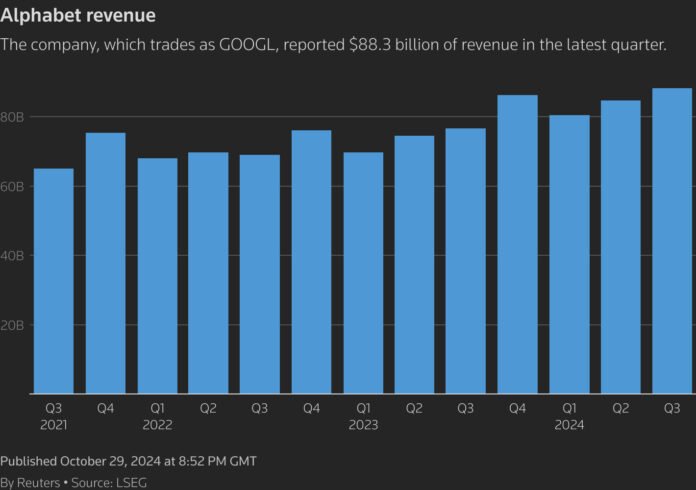

Alphabet exceeded revenue and profit expectations for the third quarter. Key search activity increased 12%, as did YouTube ad revenue.

“Alphabet is the first big tech name to report profits, and it hasn’t disappointed,” said Matt Britzman, senior equity analyst at Hargreaves Lansdown. “Cloud growth has been strong… which continues to support the argument that the major cloud providers are well positioned to benefit from the AI revolution.”

Seen as slow to overtake Big Tech rival Microsoft in the AI race, Google has beefed up its Gemini AI chatbot and improved its AI-powered search.

The company continues to spend a lot of money on AI.

New Chief Financial Officer Anat Ashkenazi said on her first analyst call that Alphabet’s capital expenditures would be higher in 2025 than this year.

In the third quarter, Alphabet’s capital expenditures rose 62% to $13 billion. The fourth quarter is expected to be similar, she said.

Some analysts said Alphabet’s quarter looked impressive compared to low expectations, and that Alphabet’s small but growing cloud business could slowly offset its slowing advertising business.

But cloud business grew the fastest in eight quarters — to $11.35 billion — thanks to companies doubling their spending on cloud, which is key to powering artificial intelligence technologies. Analysts estimate $10.86 billion.

Item 1 of 2 People attend a presentation by Vice President, UX, Gemini experiences and Google Assistant Jennifer Blackburn on the Gemini Live feature during the Made by Google event in Mountain View, California, US, August 13, 2024. REUTERS/ Manuel Orbegozo/File Photo

“I think it was an impressive quarter because the fact that Google Cloud was able to more than offset the decline in search speaks to both the growing importance of cloud revenue and the fact that the company continues to diversify its revenue base,” says Bob O’Donnell, President of TECHnalysis Research.

Google has rolled out ads in AI Overviews, which use generative AI to summarize content from a range of sources and show summary results for searches.

Analysts said users think the company’s new AI tools are more effective than before – a significant improvement from earlier this year, when the feature was harshly criticized for displaying inaccurate answers, including a pizza recipe that listed glue as an ingredient mentioned.

Alphabet also beat earnings expectations with a profit of $2.12 per share, compared to an average market estimate of $1.85, LSEG said.

SHARE LOSING

“We had a slight tailwind from election-related ad spending in the third quarter, which was a little more pronounced in YouTube ads,” Google’s Chief Business Officer Philipp Schindler said on a post-earnings call.

Alphabet’s digital advertising revenue – the largest share of total revenue – rose 10% to $65.85 billion in the third quarter. But that growth rate slowed from the second quarter.

“I absolutely expect Google to start losing market share in the advertising market over the next two to three years,” said Angelo Zino, senior equity analyst at CFRA Research. “It is clear that as we move towards an AI-driven market, competitive pressure will increase as a result.”

Google’s share of U.S. search ad revenue is expected to fall below 50% next year for the first time in at least 18 years, according to data from eMarketer. Meanwhile, Amazon’s share is expected to grow to 24% from 22% this year.

Sign up here.

Reporting by Deborah Sophia in Bengaluru, and Kenrick Cai and Greg Bensinger in San Francisco Additional reporting by Akash Sriram in Bengaluru Editing by Anil D’Silva, Sayantani Ghosh and Matthew Lewis

Our Standards: Thomson Reuters Trust Principles.