Key insights

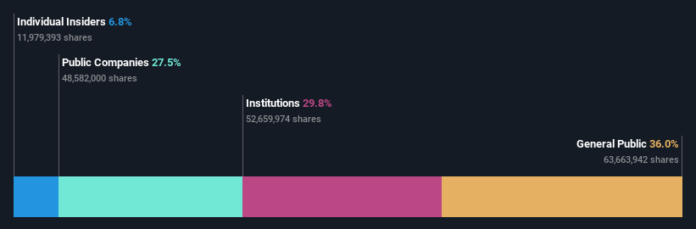

To get an idea of who is really in control of Internet Initiative Japan Inc. (TSE:3774), it is important to understand the ownership structure of the company. And the group that owns the largest share of the pie are private investors with 36% ownership. In other words, the group faces maximum upside potential (or downside risk).

While institutions, which own 30% of the shares, were not spared from last week’s market capitalization of JP¥23b, retail investors as a group suffered the maximum losses

In the diagram below, we zoom in on the different ownership groups of Internet Initiative Japan.

See our latest analysis for Internet Initiative Japan

What does institutional ownership tell us about the Japan Internet Initiative?

Many institutions measure their performance using an index that approximates the local market. So they tend to pay more attention to companies included in the major indices.

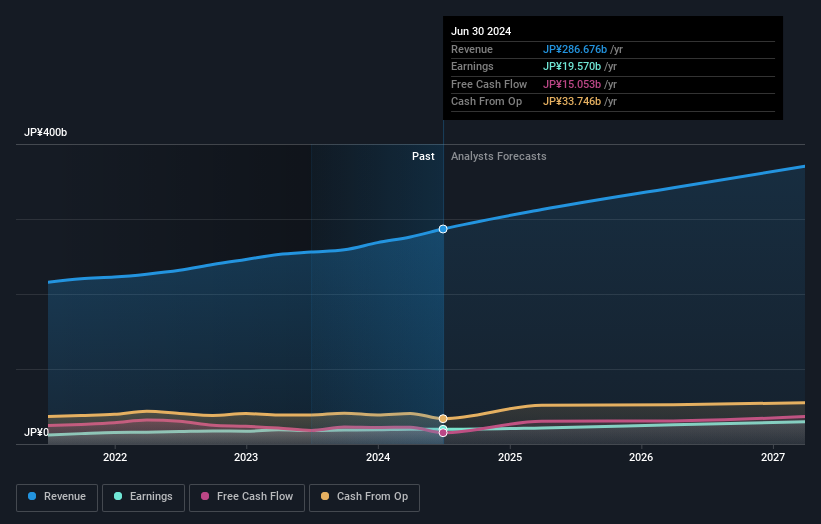

We can see that Internet Initiative Japan has institutional investors; and they own a large portion of the company’s stock. This means that the analysts working for these institutions have looked at the stock and they like it. But like anyone else, they can be wrong. When multiple institutions own a stock, there’s always a risk that they are in a ‘crowded trade’. When such a transaction goes wrong, multiple parties may compete to sell shares quickly. This risk is greater in a company without a history of growth. You can see Internet Initiative Japan’s historic earnings and revenue below, but keep in mind there’s always more to the story.

Hedge funds don’t have many shares in Internet Initiative Japan. The company’s largest shareholder is Nippon Telegraph and Telephone Corporation, with 12% ownership. For context, the second largest shareholder owns approximately 12% of the outstanding shares, followed by an ownership of 6.0% by the third largest shareholder. Koichi Suzuki, the third largest shareholder, also happens to hold the title of chairman of the board.

A closer look at our ownership figures shows that the top 11 shareholders have a combined ownership of 51%, implying that no single shareholder has a majority.

Institutional ownership research is a good way to measure and filter the expected performance of a stock. The same can be achieved by studying analyst sentiments. There are plenty of analysts covering the stock, so it might be worth seeing what they are predicting as well.

Insider owned by Internet Initiative Japan

The definition of an insider may vary slightly from country to country, but board members always count. The management of the company is accountable to the board and the latter must represent the interests of the shareholders. It is striking that managers at the highest level sometimes sit on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, sometimes too much power is concentrated within this group.

Shareholders would probably be interested to hear that insiders own shares in Internet Initiative Japan Inc.. It’s a pretty big company, so it’s generally positive to see a potentially meaningful alignment. In this case, they own about JP¥34 billion worth of shares (at current prices). It’s good to see this level of investment by insiders. Here you can check if these insiders have purchased anything recently.

General public property

The general public – including private investors – owns a 36% stake in the company and therefore cannot be easily ignored. This size of ownership, while significant, may not be enough to change company policy if the decision is not in line with other major shareholders.

Owned by a public company

We can see that listed companies hold 27% of the issued shares of the Internet Initiative Japan. We don’t know for sure, but it’s entirely possible that this is a strategic deployment. The companies can be similar or work together.

Next steps:

While it is worth considering the different groups that own a business, there are other factors that are even more important.

I always like to check if there is one history of sales growth. You can also do that by consulting this free overview of historical earnings and revenues detailed chart.

But eventually it is the futureand not the past, which will determine how well the owners of this company will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

Please note: The figures in this article have been calculated based on data from the past twelve months, which relates to the twelve-month period ending on the last date of the month in which the annual accounts are dated. This may not correspond to the figures in the full annual report.

New: AI stock screener and alerts

Our new AI Stock Screener scans the market every day to discover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider buying

• Fast-growing technology and AI companies

Or build your own statistics based on more than 50 statistics.

Discover now for free

Do you have feedback on this article? Worried about the content? Please contact us directly from us. You can also email the editorial team (at) Simplywallst.com.

This article from Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only an unbiased methodology and our articles are not intended as financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. We aim to provide you with targeted, long-term analysis based on fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or quality material. Simply Wall St has no positions in the stocks mentioned.