AI could give this optical networking company a major boost.

Optical networking company Ciena (CIEN -1.77%) may not be a household name in the tech sector, but the stock has been in red-hot form on the market over the past three months, posting an impressive 35% gain at the time of writing.

However, when we take a closer look at the company’s recent financial performance, this recent rally seems surprising. Ciena’s revenue and profit fell in the third quarter of fiscal 2024 (for the three months ended July 27). But investors appear optimistic about the potential turnaround in Ciena’s fortunes thanks to a recovery in telecommunications spending and growing adoption of artificial intelligence (AI).

Here we take a closer look at the reasons why Ciena could become a beneficiary of the AI proliferation and maintain its new-found momentum in the stock market.

The worst seems to be over for Ciena

Ciena’s third-quarter revenue fell 12% year-over-year to $942 million, while non-GAAP (adjusted) net income fell 41% from the same period last year to $0.35 per share. These sharp declines were due to the poor performance of the company’s networking operations. Specifically, Ciena’s optical networking revenue fell 15% from the same period last year, while routing and switching revenue fell 27%.

Ciena has been hit hard by the downturn in the telecom equipment market that started in the second half of 2023. Global telecom spending fell 17% in the first half of 2024, according to market research firm Dell’Oro Group. negatively impacted Ciena’s order book and the excess inventory the company was left with has weighed on margins.

Dell’Oro estimates that telecom spending could fall 8% to 10% in 2024, compared to last year’s 4% decline. However, Citi Group points out that the scenario in the North American telecommunications sector is improving, with spending expected to increase by 3% in 2025, compared to an identical decline expected for 2024.

The good thing is that Ciena is already witnessing an improvement in business conditions. The company reported healthy order inflows in the third quarter and ended the quarter with a book-to-bill ratio above 1, meaning it received more orders than it shipped during the quarter. A value greater than 1 is an indicator of strong demand for the company’s offering.

In fact, Ciena’s inventory fell to $937 million last quarter, compared to $1.2 billion in the same quarter last year. These positive developments indicate why Ciena’s outlook for the current quarter points to an improvement in the company’s revenue and operating results. The company forecasts sales of $1.1 billion in the current quarter at the midpoint, along with an adjusted gross margin in the low-to-mid 40% range.

Topline guidance points toward flat year-over-year performance, which would be a big improvement from the double-digit decline reported in the previous quarter. Additionally, the gross margin forecast indicates that operating profit erosion is likely to slow, as Ciena reported an adjusted gross margin of 43.7% in the fourth quarter of fiscal 2023.

Meanwhile, Ciena management and certain Wall Street analysts believe that the rapid adoption of AI is likely to provide a nice boost to the addressable market and growth in the future.

The need for faster connectivity in AI data centers should be a boost for Ciena

Morgan Stanley And Jefferies recently raised their price targets for Ciena stock, citing the potential impact of AI on its business. While Morgan Stanley raised its price target to $63 from $60, Jefferies has become more bullish on the stock with an $80 price target, up from $65 previously.

Jefferies points out that the potential jump in demand for faster connectivity between data centers to support the growth of AI workloads presents a solid growth opportunity for Ciena. Morgan Stanley has a similar view and believes Ciena could achieve a faster growth rate in the future thanks to growing demand for data center interconnect (DCI) technology.

Investment banks have become more optimistic about Ciena’s AI-related prospects following a recent presentation from the company in which it pointed out that global data center bandwidth will more than quadruple between 2023 and 2027. As a result, Ciena management believes that demand for optical bandwidth could increase faster than the historical annual average of 25% to 30%.

The good thing is that Ciena is already witnessing a positive impact on its business through the adoption of AI. As management noted during the company’s latest earnings conference call: “In the third quarter, we delivered new wins with customers of major cloud providers, including terrestrial, submarine and coherent plug-in applications, the majority of which were driven by preparations for the expected growth in AI and cloud traffic.”

Dell’Oro Group estimates that spending on back-end networks to connect data centers could double over the next five years, bringing annual revenue to $80 billion. So don’t be surprised if you see an acceleration of Ciena’s growth in the future; this is exactly what analysts expect from the company.

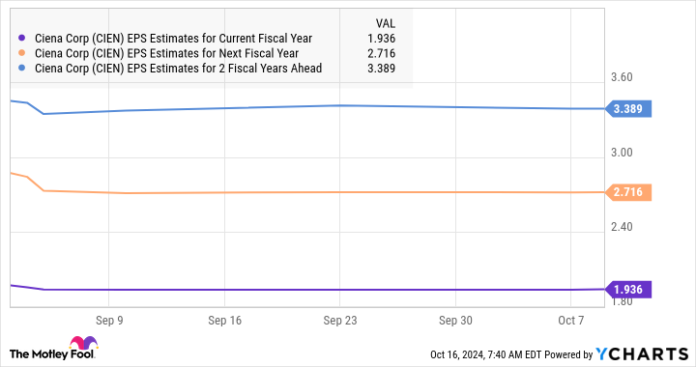

CIEN EPS estimates for current fiscal year data according to YCharts

Ciena’s operating income was $2.72 per share in fiscal 2023. That figure is expected to drop this year, as the chart above shows. However, the company’s profits will rise at an impressive pace in the coming years.

Assuming Ciena earns $3.39 per share in fiscal 2026 and trades at 25 times earnings at that point (in line with its forward price-to-earnings ratio), its stock price could reach $85 in a few years. That would represent a 25% jump from current levels. But if the market decides to reward it with a higher earnings multiple and the company manages to deliver stronger earnings growth thanks to the improving addressable market, don’t be surprised if Ciena posts stronger profits.

Investors looking to buy a potential AI winner might consider buying Ciena, which trades at an attractive 2.5 times revenue and 25 times forward earnings, and whose bull run is about to continue.