Broadcom’s connectivity solutions are driving the AI buzz.

Broadcom (AVGO -0.90%) is a popular choice in the artificial intelligence (AI) investing world. However, it is not as clear as investing in Nvidia or Palantiras both companies generate a significant portion of their revenue from AI offerings.

Broadcom’s product line has a much broader reach, making it a more diversified investment. However, diversification can also cause a company to miss out on huge technological developments. So, is Broadcom a great AI choice? Or is the product line too widespread to take advantage of this generational change?

A non-AI division is behind Broadcom’s growth

If you look at Broadcom’s product page on its website, you may be overwhelmed by the sheer number of choices it offers. It offers both hardware and software, such as cybersecurity and mainframe software, as well as connectivity products. Its largest software product came as an acquisition when it bought VMware.

VMware offers virtual desktop services to its customers via the cloud and has little to do with AI, even though it is a useful service. VMware is also a major reason why Broadcom is showing revenue growth.

In the third quarter of fiscal 2024 (ending August 4), Broadcom’s revenue grew 47% year over year to $13 billion. However, when excluding VMware’s contribution (because VMware’s results were not included in the fiscal 2023 third quarter results), Broadcom’s revenues only rose 4% year-over-year.

For a company portrayed as a strong AI investment, that’s pretty weak growth, considering other AI-focused investments are growing very quickly.

However, if you dig deeper, you’ll find that Broadcom’s AI products crush it.

The price tag on Broadcom stock may be too high to afford

Broadcom’s biggest AI products are the connectivity switches and the custom accelerators that Broadcom helped design, like Alphabet‘s tensor processing unit (TPU). Custom accelerators grew 350% year over year in the third quarter, and Ethernet switching devices (used in servers to direct the flow of information) increased 400% year over year.

That’s impressive growth for these two product lines, but the positive effect is drowned out by other Broadcom business segments that aren’t doing as well.

Still, Wall Street expects Broadcom’s growth to pick up in fiscal 2025, with 37 analysts forecasting revenue growth of 17.5% on average. They clearly see that this AI tailwind will have a bigger impact next year, but does that make the stock a buy now?

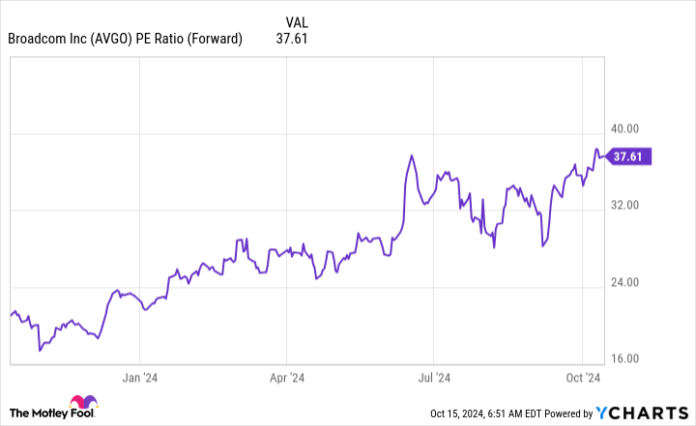

Broadcom stock isn’t cheap. It yields a pretty hefty premium of almost 38 times forward earnings.

AVGPO PE ratio (forward) data by YCharts.

Those are pretty high expectations, and so far Broadcom hasn’t met them if you take out the effect of VMware.

Broadcom is a great company with excellent products. However, because it has so many product lines, it’s hard to see what effect AI is having on the business. The market seems to believe that investors will see this effect in 2025, but that seems like a lofty expectation considering that AI has been riding the wave for about a year and a half.

I think investors can pick much better AI stocks than Broadcom because many of them are growing faster and trading at a much cheaper price tag than Broadcom (like Alphabet or Metaplatforms). Broadcom can prove me wrong, but I’m not willing to take the risk given the price tag its stock is trading at.

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet and Meta platforms. The Motley Fool holds positions in and recommends Alphabet, Meta Platforms, Nvidia, and Palantir Technologies. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.