This company has long been a mover and shaker in AI (and may still be a leader).

When it comes to stocks, driven by increased interest in all things artificial intelligence (AI), investors have been drawn to Nvidia. In a way, this is understandable, as Nvidia’s vision provided an early lead in the AI chip industry amid the sudden demand for generative AI capabilities.

The problem with this focus is that the AI industry extends far beyond Nvidia. That could cause you to overlook opportunities that could potentially match or even surpass that stock in the future. Given the dynamics of the AI industry, it could be time for investors to turn to AI leaders like Google parent company Alphabet (GOOGL 0.40%) (GOOG 0.45%).

The case for Alphabet

AI investors should stay tuned to Alphabet as it is one of the original AI stocks. The company first started using AI in 2001 when it started applying spell checkers to Google searches. From then on, AI technology developed and for years most industry analysts considered the company a leader in AI.

However, that changed in the spring of 2023 when OpenAI released the latest version of the generative AI chatbot ChatGPT. That company collaborated with a competitor Microsoft and ran its servers on Nvidia chips, which seemed to leave Alphabet and its companies out of the mix.

Despite the perception the Microsoft-OpenAI deal has created, it’s unclear whether Alphabet is “behind” in AI. The company responded quickly by launching its own updated generative AI chatbot Bard in the spring of 2023, followed by Google Gemini in December of that year.

Additionally, it has taken a different approach to AI, deploying its Google Research and Google DeepMind teams to emphasize the development of each layer of the AI stack. It focuses heavily on the ethical and safety issues that can come with AI. In addition, it has developed one of the most popular AI libraries with TensorFlow, a free open source library for machine learning. That perspective could help set Alphabet apart as awareness of AI’s potential grows.

Financial and stock characteristics

Investors should also remember that Google’s parent company has nearly $101 billion in cash. This gives it enormous resources to succeed with AI. Additionally, Alphabet generated over $30 billion in free cash flow in the first half of the year alone, bringing additional flexibility to help the company address any technical gaps.

The financials show that things are not as bad as some investors might think. In the first half of 2024, Alphabet’s revenue grew 14% annually to $165 billion. As the company maintained cost and expense growth at just 7%, net profits rose to $47 billion during the period, an annual increase of 42%.

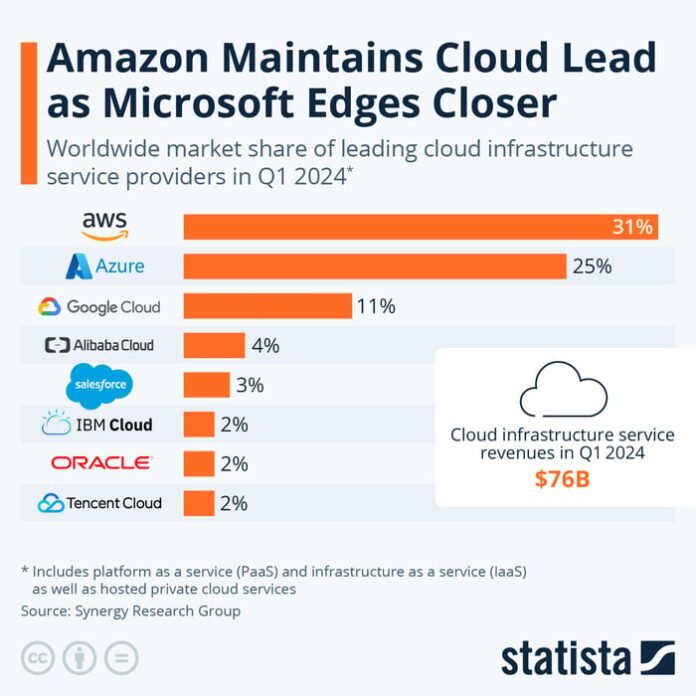

Also, one figure in the financials highlights the importance of AI in the company’s growth trajectory, namely Google Cloud’s performance. It accounted for $20 billion of the company’s revenue in the first two quarters of 2024 and saw an annual increase of 28%, about double Alphabet’s total revenue growth in that time.

Moreover, Google Cloud is lagging behind Amazon and Microsoft in that sector, its market positioning shows that it plays a crucial role in the cloud industry, highlighting the need to succeed in AI.

Image source: Statista.

That’s why many investors still seem to have confidence in Alphabet’s shares, which are up nearly 20% over the past year. Furthermore, a drop in share price has left the company with a price-to-earnings ratio of 24, the lowest among its ‘Magnificent Seven’ peers. That lower valuation could lead investors back to the stock as more people come to appreciate the company’s competitive position in the AI industry.

Buy Alphabet shares

Given the company’s position and stock performance, it’s likely time for investors to return to Alphabet stock. Some competitors have made significant strides in AI, leading many to wonder whether Google parent company is still the market leader in this technology.

However, the company quickly responded with its own generative AI offering. Since the cloud plays a crucial role in AI implementation, Google Cloud has helped drive the company’s growth.

Ultimately, it’s probably too early to write off Alphabet in the AI race. With a rising stock price and a low valuation among its mega-tech competitors, investors should consider following the Google parent company more closely.

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Will Healy has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Alphabet, Amazon, Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.